Sending out invoices is your gateway to getting paid for the services you are providing. When you’re self-employed and working under a government-controlled scheme like the NDIS, getting your invoicing right is super important.

Your invoice is essentially your request for payment after you have delivered your product or service and has a number of requirements. There are standard invoicing guidelines such as the need to include your business details and ABN, plus there are NDIS guidelines that are either essential or best practice for getting your invoices approved and paid as quick as possible.

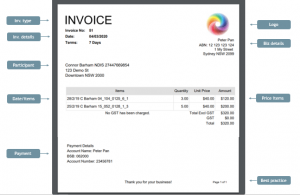

In this article I am going to show you a quick screen shot of an invoice created on the free Solo & Smart app and highlight the key major parts of the invoice.

Invoice Type

The type of invoice you create will depend on whether your business is registered for GST or not. If your business is not registered for GST, then your invoice should just display the words ‘Invoice’ like the image above. If you are registered for GST, then your invoice should say the words ‘Tax Invoice’ at the top.

A business with a turn over of $75,000 or more, is required to be registered for GST, meaning that they will charge 10% on top of their products and services (note this is different in the NDIS), and pay GST to the tax office in the Business Activity Statements (BAS).

Remember, that in the NDIS the majority of services are GST-Free, meaning that even if you are registered you won’t be charging GST on top, although your invoice should still say ‘Tax Invoice’.

Invoice Details

Your invoice should include some basic information to help both you and your customers keep track of the invoices you are sending. Typically, this will include an invoice number, the date of the invoice and your payment terms.

Participant Details

Highlighting the participant you are working with is important to being able to claim for services through the NDIS. Your invoice should clearly identify the participant’s name and include their NDIS participant number. You should also include basic details such as an address to further identify the customer/participant you provided services to.

Services Provided

Next comes the services themselves, which is where you can clearly articulate the service or services that were provided. It is best practice to breakdown the invoice into each of the items charged so they customer/participant can clearly see what they are paying for.

In the NDIS, each product or service fits into a range of categories and has a specific unique code that will correspond to the categories the participant has received funding for. This code can be found online in the price guides but be careful to ensure you use the correct code. If you are unsure check with the participant themselves, their plan manager or support supervisor if applicable.

Payment Details

Your payment details should be clearly shown at the bottom of the invoice to make it easy for your customers to pay you promptly.

Logo

Including your business branding on the invoice helps to show your professionalism with a clean and clear layout. It is not essential but will help you to build a reputation and brand associated with your logo.

Your Business Details

Your invoice will need to include your business details including your business name, your ABN and your business address to identify yourself as the business supplying the services.

Pricing

Corresponding to your services provided should be the quantity and unit price for the services provided. Be sure to review the NDIS price guides to ensure your price fits within their guidelines and what was agreed with your customer/participant.

Best Practice for Comments

Comments can be used to convey extra messages to the customer to help build your loyalty and connection with them. Simple messages like ‘thank you for your business’ go a long way.